Tax Compliance in Greece: SAP Public Cloud Meets MyDATA

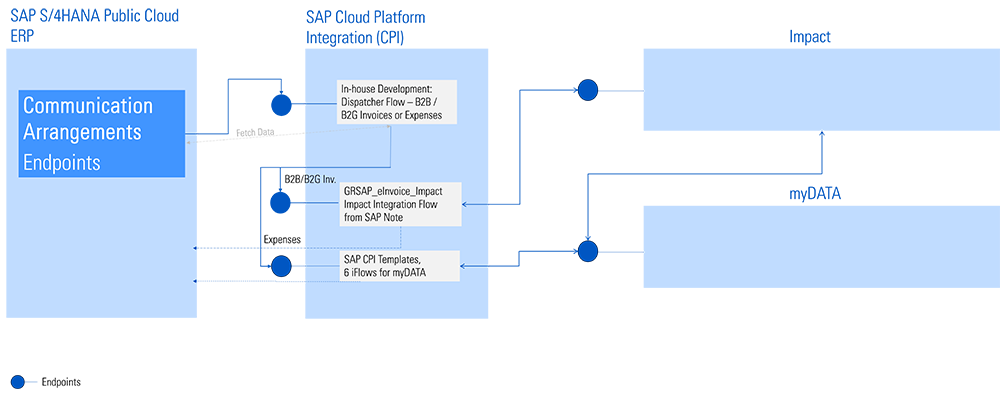

The customer faced the challenge of implementing a legally compliant solution for electronic invoice transmission in Greece using SAP S/4HANA Public Cloud. As no sufficient standard interface was available at the time, XEPTUM developed an integrative implementation of eInvoicing in S/4HANA Public Cloud in Greece via the MyDATA interface – based on the SAP Integration Suite. This enabled full compliance with the mandatory B2G integration requirement, implemented on time and entirely cloud-based.

What Is MyDATA (My Digital Accounting and Tax Application), and What Are the Obligations for Companies in Greece?

MyDATA is a digital platform launched by the Greek tax authority (IAPR) aimed at modernizing and digitizing tax and accounting processes. Companies operating in Greece are required to electronically transmit their tax and accounting data via MyDATA. This obligation includes reporting income and expense documents as well as accounting entries to ensure comprehensive and transparent e-bookkeeping. Compliance is mandatory for all companies and is intended to increase tax transparency and reduce administrative workload.

What Types of Business Transactions Must Be Reported to the MyDATA Platform?

The following types of business transactions must be reported to MyDATA:

- B2B and B2G Transactions

- Invoices

- Credit Notes

- Payments

- Delivery Notes

- Other Financial Transactions such as Expenses

- B2C Transactions

These reports are essential to provide the tax authority with a transparent overview of a company’s financial reporting processes and to ensure tax regulation compliance. For both B2B and B2C, data transmission occurs in real time.

Can the Integration With MyDATA Be Automated?

Yes, MyDATA integration can be automated to minimize manual effort. In an on-premise system, e-invoices can be sent directly to the tax authority. In contrast, with SAP S/4HANA Cloud, a middleware – such as the SAP Integration Suite in our case – must be introduced. In both scenarios, it is mandatory to use a licensed third-party provider as a middleman. This means that data from your own system and middleware cannot be sent directly to MyDATA but must instead be routed through a certified service provider who forwards it to the government portals.