SAP Document and Reporting Compliance: Efficiency Through Smart Automation

Companies around the world are facing the challenge of complying with legal e-invoicing requirements in an increasing number of countries. With SAP Document and Reporting Compliance (DRC), SAP offers a powerful solution to meet these demands.

E-invoicing is becoming the global standard – and is already mandatory in many countries. This presents companies with the challenge of implementing legal requirements in a timely and efficient manner. SAP’s answer to this is SAP Document and Reporting Compliance, a dedicated tool designed to help businesses navigate the “compliance jungle” and seamlessly integrate regulatory obligations into existing processes.

What Exactly Can SAP Document and Reporting Compliance Do?

SAP’s solution ensures compliance with local tax regulations by adhering to the respective country-specific tax laws and rules. If a company operates in multiple countries, the applicable tax configuration is automatically used for each transaction. Additionally, the tool enables real-time transmission of tax documents to the relevant authorities.

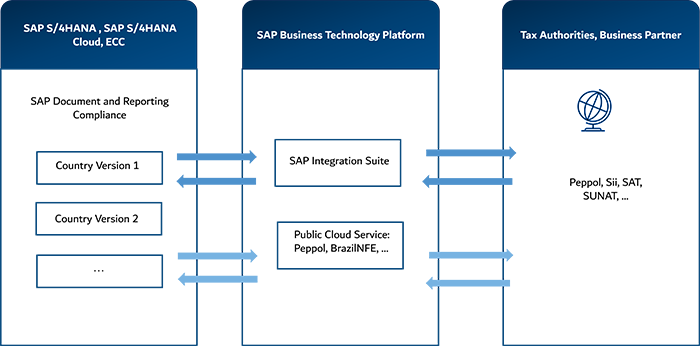

SAP DRC can be used across different SAP system landscapes – including SAP S/4HANA Cloud, On-Premise, or classic SAP ERP:

In SAP S/4HANA Cloud, the solution is already tightly integrated into the system architecture. In the On-Premise version of S/4HANA and in classic ERP, SAP DRC can still be used, but integration and customization require more effort.

Regardless of the system landscape, electronic documents or reports are generated within the business system and forwarded via a secure connection to the SAP DRC Cloud Service on the SAP Business Technology Platform (BTP). From there, communication takes place with the relevant government platforms – for example, to submit e-invoices or tax returns in accordance with local regulations. SAP DRC distinguishes between two main components, which are connected via the Cloud Connector:

• The Compliance Cockpit, embedded directly within the SAP ERP system, is used to create, edit, and correct tax-relevant documents.

• Compliance Integration, which runs on the SAP BTP, handles the technical connection to country-specific authority platforms and ensures legal requirements are met.