SAP Credit Management: All Receivables and Credit at a Glance!

SAP's solution for centralized credit management – keep a close eye on the creditworthiness of your business partners, reduce your financial risk, and make efficient credit decisions.

Does Your Company Need SAP Credit Management?

Do you have difficulty monitoring credit risk and payment delays? To what extent is your credit management process integrated into Financial Accounting? On what basis do you make credit decisions? Do you keep a close eye on the creditworthiness of your customers? Is your receivables default risk too high? When making a credit decision, would you also like to take data from non-SAP systems into consideration?

Is SAP Credit Management the Solution for Optimizing Your Receivables and Credit Management?

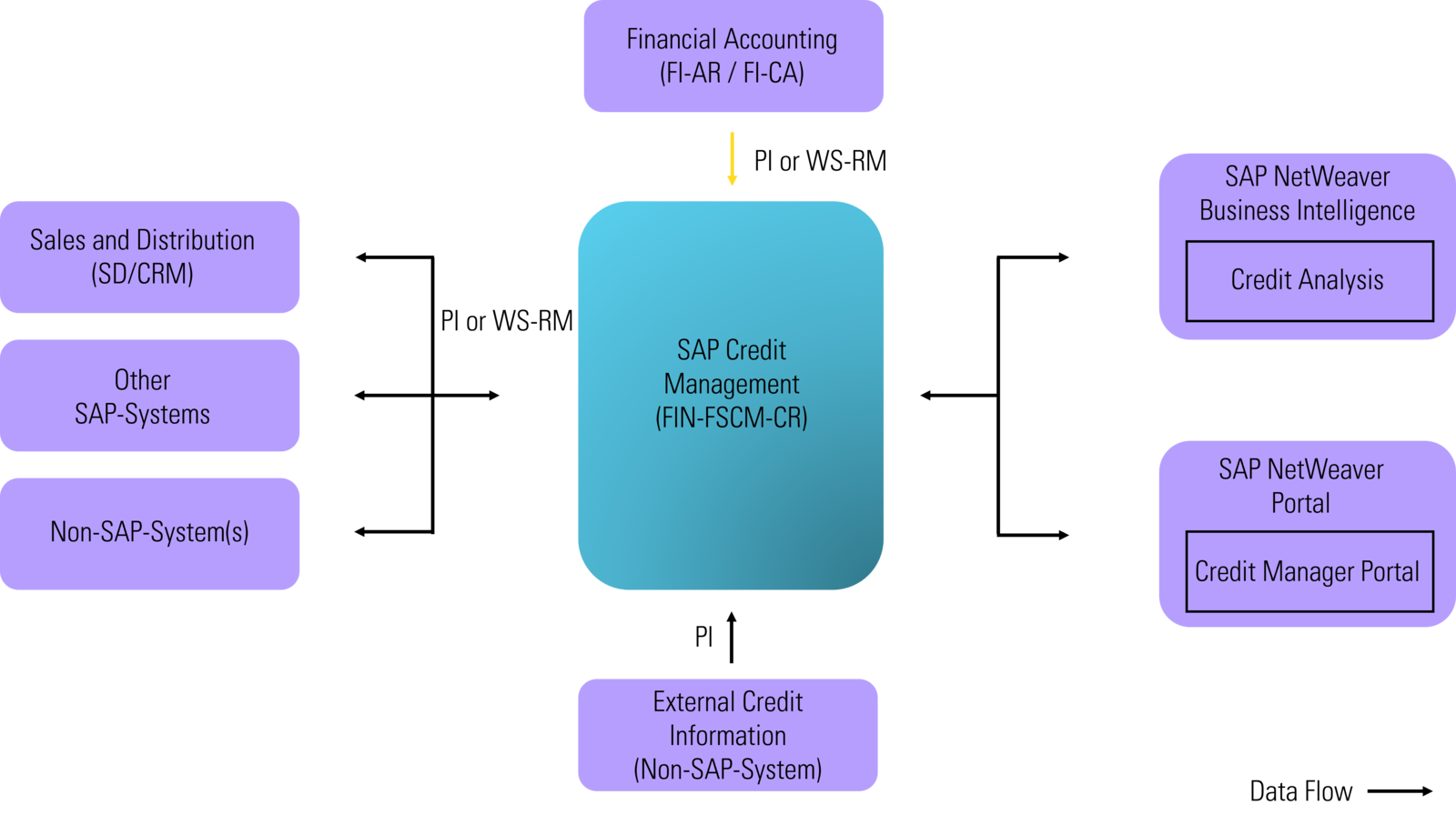

SAP Credit Management, which is part of SAP Financial Supply Chain Management (FSCM), provides a central, workflow-supported platform for monitoring credit risk and payment delays. It also checks credit exposure from other SAP modules (Sales and Logistics) against the current credit limit (integrated feature).

Credit Management provides you with a central platform for maintaining and managing all relevant master data. Credit decisions are supported by the Credit Rules Engine, which can be used to automatically score business partners. Internal and external credit information is taken into consideration.