Changes to Asset Insurance Value Mapping in S/4HANA

Alongside the many changes to business processes in S/4HANA, the mapping of insurance values in asset accounting has also changed. For companies planning to transfer their asset accounting to SAP S/4HANA, this brings challenges in respect of the transfer, mapping, and determination of insurance values.

We will show you the procedure for mapping and transferring asset insurance values to SAP S/4HANA.

In the ERP system, there were two ways to map insurance values:

- Enter insurance values in the asset master record

- Use a dedicated depreciation area to map the insurance values

What are the Changes in SAP S/4HANA?

The frequently used first variant, entering insurance values in the asset master record, is no longer available in SAP S/4HANA – whether as Customizing or as fields in the asset master.

Now, only the second option is available; managing insurance values in a dedicated depreciation area. What this means is that, to map insurance values in SAP S/4HANA, a new depreciation area for insurance values must be created in the chart of depreciation and the depreciation area must be defined in the asset classes of the assets concerned.

What about already existing Data?

The new depreciation area applies only to new assets, but not to existing assets. A special program is available for existing assets. As an alternative, transfer postings can be done manually during the migration to SAP S/4HANA, or the new depreciation areas can also be implemented and created for existing assets in the ERP system before migrating to SAP S/4HANA.

How will the Insurance Values be determined in the Future?

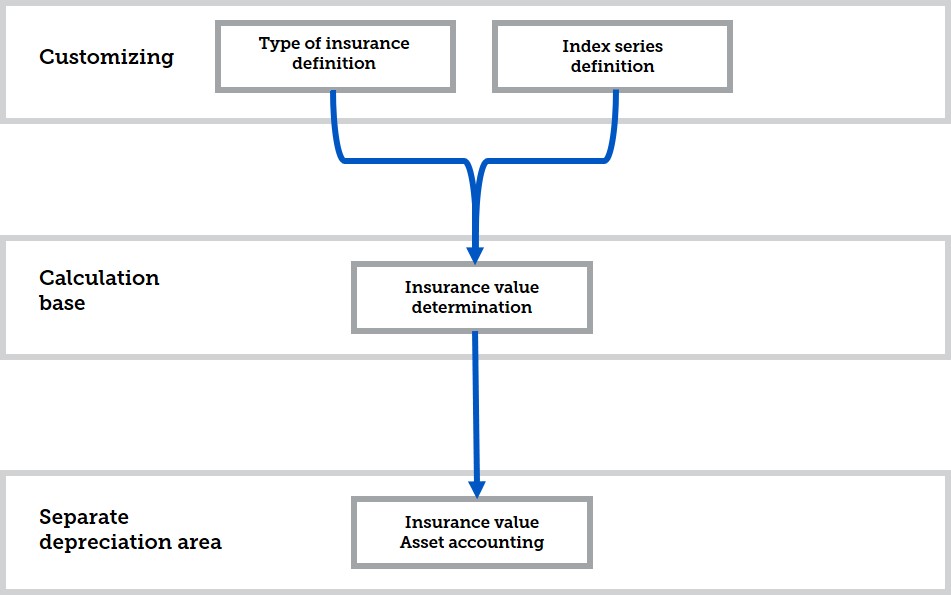

Insurance data can no longer be maintained in the asset master record. In view of this, it is necessary to maintain insurance types and index series, which are used to calculate the insurance values.

There are two different calculation bases:

- Value as new insurance – the insurance value is calculated from the base insurable value

- Current market value insurance – the insurance value is calculated from the book value

The following graphic illustrates the mapping of insurance values in asset accounting: